Vision Insurance

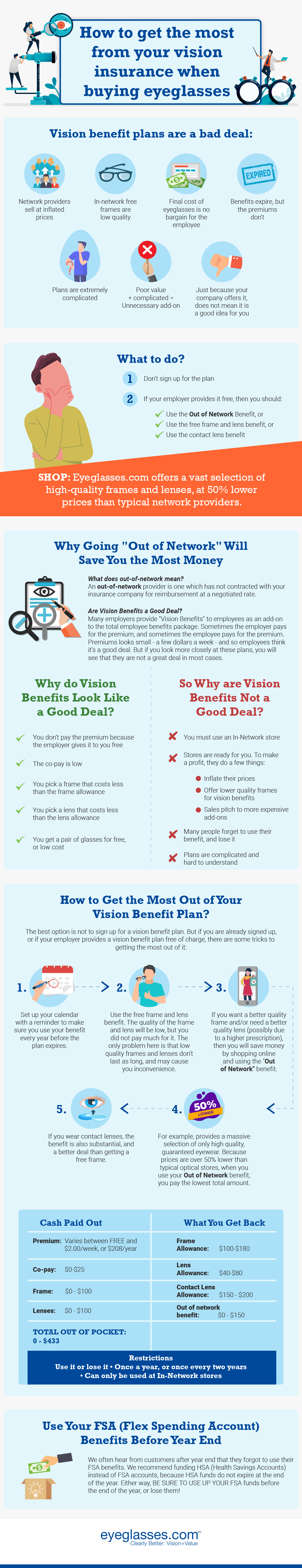

Vision insurance is incredibly complicated and difficult to use, and most people wonder what the best way is to get the best value vision care for themselves and their family's eyesight at the best possible cost. You may be familiar with the concept of vision plans. Unfortunately, if you are looking for affordable and quality vision benefits, the typical vision insurance plans served by an in network provider may not be the right choice for you.

OUT OF NETWORK? USE THIS CLAIM FORM

Contact Your Vision Insurance Benefits Company - Links

Aetna

Avesis

Block

Blue Cross Blue Shield

Davis Vision

Eyemed

Humana

Spectera

VSP

At Eyeglasses.com, we see a lot of people struggling with employer provided insurance plans that don't meet their needs and fail to keep vision care costs low. So which is the best vision coverage to avoid out of pocket costs and not sacrifice on quality vision care? We guide you through the options available.

Pros and Cons of Vision insurance plans benefits from your employer

You might think that employer's health insurance plans that include a vision plan can save you costs and efforts. Indeed, as long as you pick a frame or contact lenses that are under the relevant allowances, the plan handles the rest. Besides, you can even receive low-cost or even a free pair of glasses from stores within the agreed network.

Cost-wise, the co-pay for company vision plans appears low. In many cases, you receive the premium for free as it is paid by your employer. But in reality, they can drive your costs higher, making it tough to receive adequate eye care. Here is why company insurance cover is doing nothing for your eye health and eye costs:

The costs of vision insurance from an in network provider

First of all, you can only receive vision services from network stores. These tend to sell services at an inflated cost, which means you essentially pay more than necessary for eye care.

Contrary to common belief, despite having work-provided vision insurance, the final costs of prescription glasses remains expensive for the employee. In other words, the vision plans do not necessarily save money on your glasses and contact lenses.

While you may have benefits as part of the plan, these expire rapidly if they are not used.

The value of vision insurance by in network providers

Vision coverage is typically part of an overall health insurance plan that is designed to meet the needs of the median plan user. Yet, those needs are unlikely to align exactly with your unique eye health needs. This means that in the case of insurance work provided, the plan can deliver little to no value at all to the individual. It is likely to have unnecessary and expensive adds-on that are not relevant to your health.

You are entitled to free in network frames for vision correction as part of the plan. Unfortunately, network cover glasses tend to be low quality.

Finally, the typical vision insurance plan is complicated. it can be hard to understand what is included in your vision insurance cover and whether you've got free access to the vision services you need.

What to do instead of getting your company's vision plan and benefits

Receiving vision insurance work funded is not necessarily a good idea for your eye care and budget. At Eyeglasses.com, we warn people about signing up for an employer-provided vision plan. As explained, just because the company provided vision plans, you could still face high costs and low quality of care.

So, instead, we strongly recommend considering other alternatives for your vision care. Some employers provide different benefits that could be more valuable than those in the vision plans:

-

Contact lenses benefit

-

Free frame and lens benefit

-

Out of network benefit

Understand how to leverage benefits in your vision insurance

Benefits are, simply put, something that is part of of your health plan for vision and that are valid only for a limited period of time. Benefits are typically renewed once a year or once every two years. Unfortunately, if they are not used, you lose them. The main issue about benefits is that most people assume they only apply to store within your health plan network. In reality, there are different types of benefits, including out of network ones.

Making the most of your existing vision benefit plan

In an ideal world, you want to avoid vision insurance plans including benefits. However, it doesn't mean you should cancel your employer-provided vision insurance plan, especially if benefits and premiums are free of charge.

Yet, it is essential to make the most of your plan without driving your vision insurance cost high. Here are 5 handy value-enhancing plans vision insurance tips.

Set benefit reminders

Most people accidentally let their benefits expire. So, if you don't want to lose them every year, make sure to have calendar reminders to use your benefits at stores that are part of the network.

Utilise your frame and lens benefits

You have access to low-cost contact lenses and glasses. While the quality is low and they may not last long, it can still be a great deal to get a second pair of glasses or lenses. You can use them as your emergency pair.

buy better quality vision correction at out of network stores

Indeed, you're more like to get a better deal on the cost and the quality, especially if you need higher prescription glasses.

Wear contact lenses

You may find that correction for your vision problems is cheaper when you choose contact lenses over glasses.

Maximize your out of network benefit

Did you know that the out of network benefit could cut down costs by over 50% compared to the stores that belong to your vision plan network?

What to know about out of network benefits

These benefits tend to be more valuable as out of network stores do not inflate their prices and do not restrict your purchases. While there is a fixed dollar amount when it comes to reimbursement, it is a lot easier to find quality eyewear at a lower cost when you are not limited to your network stores.

How does vision benefit expire at the end of the year?

Let's clarify health insurance benefits. There are different types of benefits available for vision insurance. The benefits is a type of funding that can be spent on prescription glasses, sunglasses, and contact lenses.

We've already mentioned stores within and without your network; this is one type. But you will also find benefits divided between:

-

Flex Spending Account (FSA)

-

Health Saving Accounts (HSA)

These benefits do not share the same expiration period. FSA funds must be used within the year otherwise you lose them. When it comes to HSA, the funds do not expire at the end of the year.

Where to find the best health plan for eye care?

A lot of employers offer general health plans. Typically, when it comes to eye health, the plan covers glasses as long and they need the agreement set by the network stores. However, if you want better access to eye care and other health elements, such as dental plan, it may be better to shop around for your own health insurance.

Guardian direct is a favorite for both vision and dental insurance plans with a whole set of unbeatable advantages you can't get via an employer-provided plan. More importantly, the insurer also has an advantageous offer for those who are leaving an existing Guardian plan that was sponsored by their employer to invest in their own insurance plan instead.

What's included in their vision insurance plan?

The plan includes not only the typical correction but also routine eye exams with an eye doctor from the approved network. With annual eye exams done by a certified eye doctor, it's easier to stay on top of your vision. Ideally, you want a plan that covers routine eye exams at least once a year to preserve your vision health.

It's worth mentioning that people who choose additional correction solutions, such as laser vision correction, can also benefit from savings with this provider.

The plan also include full family cover, which means you can also ensure everybody receive eye exams and sufficient eye exams glasses if necessary. Routine eye tests are absolutely crucial for individuals who are at risk of health conditions, such as diabetes and high blood pressure. So, booking your routine eye exam can help detect serious conditions.

Worth mentioning too: The insurer covers annual eye exam and routine eye tests for individuals of all ages, including seniors.

Other plans from Guardian Direct

The insurance provider also provides life insurance plans via the Guardian life insurance company. It is worth checking the DTC GLIC insurance sales, the agent for all underwritten Guardian products, as the enrolment is guaranteed without waiting periods for anyone leaving an employer-sponsored Guardian plan to choose a G. Direct plan instead.

Guardian life insurance company is a wholly owned subsidiary of the Guardian insurance group.

At Eyeglasses, we can provide you with out off network benefits and support regardless your cover. Reach out to find out more about the best glasses and lenses for your needs at the best possible costs.

Infographic Design By Eyeglasses.com Eyeglasses.com

Author of this article:

Mark Agnew

Mark Agnew

CEO of Eyeglasses.com, which he founded in 1999. For over twenty years, he has educated consumers, improved their vision choices, and reduced costs in eyewear. Mark authored The Eyeglasses Buying Guide, the most comprehensive and best-selling glasses buying guide in the world.

Bio LinkedIn Blog Facebook